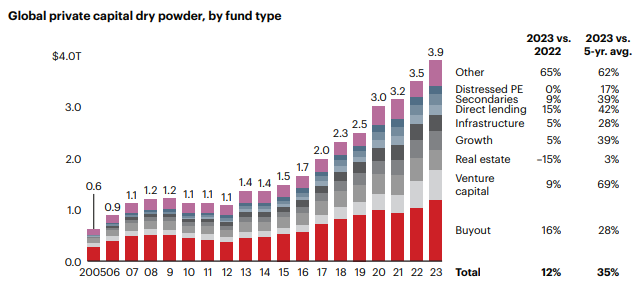

Over recent years, particularly in the UK, there has been a significant build-up of capital. UK-based venture capital and private equity investors have accumulated significant amounts of dry powder. Specifically, UK venture capital investors have raised over $25 billion in the last three years, making the UK a central hub in the European venture market (Bain). But what has led to this accumulation and what are the potential implications moving forward? Let’s delve into these questions.

Factors Leading to the Accumulation of Dry Powder

1. Economic Uncertainty: The UK has faced its share of economic and political uncertainties in recent years, most notably Brexit and the COVID-19 pandemic. Such environments often lead investors to adopt a ‘wait and see’ approach, delaying investments until more stable conditions emerge.

2. High Valuation Expectations: The last few years have seen a surge in valuations, especially in the tech sector, driven by a global influx of capital and low-interest rates. Many UK investors find themselves priced out of deals or are hesitant to invest at peak valuations, resulting in accumulated capital waiting for more reasonable pricing.

3. Increased Fundraising Efforts: Private equity and venture capital firms have been raising larger funds. This is partially because of increased investor interest in alternative assets as a hedge against potential lower returns in traditional stocks and bonds. The successful fundraising campaigns result in more dry powder needing deployment.

4. Regulatory and Political Changes: Post-Brexit regulatory changes and adjustments have also injected a level of caution among investors. The complexities involved in aligning with new laws and trade agreements make investors more meticulous and slower in pulling the investment trigger.

What May Happen Moving Forward?

1. Increase in Deal Activity: As the UK continues to stabilise post-Brexit and adapts to the post-pandemic global economy, confidence among investors is likely to rise, potentially leading to an increase in deal-making activity. This might be particularly visible in sectors that have shown resilience and potential for growth, such as technology, healthcare, and green energy.

2. Shift in Investment Strategies: Investors might begin exploring alternative investment opportunities beyond the typical sectors. This could include a greater focus on sustainability-driven companies or industries benefiting from changes in consumer behaviour post-pandemic.

3. Market Correction Influences: There is always the possibility of market corrections, which could adjust the high valuation caps and allow investors to find more reasonable entry points. This would enable private equity and venture capital firms to deploy their dry powder more effectively and freely.

4. Continued Caution: Given the lessons of recent years, a level of caution might persist, with geopolitical tensions and the evolving regulatory landscape. Investors might deploy capital more conservatively, focusing on asset classes or sectors perceived as ‘safer’ or more resilient to volatility in parts of the world which show consistent growth and predictability.

5. Impact on Start-ups and Growth Companies: An abundance of dry powder can be a double-edged sword for start-ups and growth-focused companies. While it may lead to more available funding, the competition for these funds could become fiercer. Investors are looking for businesses that not only promise growth but also demonstrate clear paths to profitability, sustainability and risk management.

The build-up of dry powder in the UK reflects broader global economic trends and local uncertainties. However, as stability returns and new opportunities are identified, we can expect to see a gradual, yet significant, deployment of this capital. For businesses and investors alike, the coming years will be pivotal in shaping the investment landscape of the post-Brexit UK economy. Those who can adapt to the evolving conditions, while managing risks effectively, are likely to emerge as the frontrunners .

Comments are closed here.